Introduction

Allegedly, Satoshi Nakamoto who created Bitcoin in 2009, vanished mysteriously two years after creating the cryptocurrency in 2011. He also created the source code of Bitcoin which is known as the hard cap. Satoshi Nakamoto put a strange and unique limitation on Bitcoin.

According to the source code of Bitcoin, the production of Bitcoin will stop at 21 million Bitcoins, and the miners will then only earn from the transaction fees.

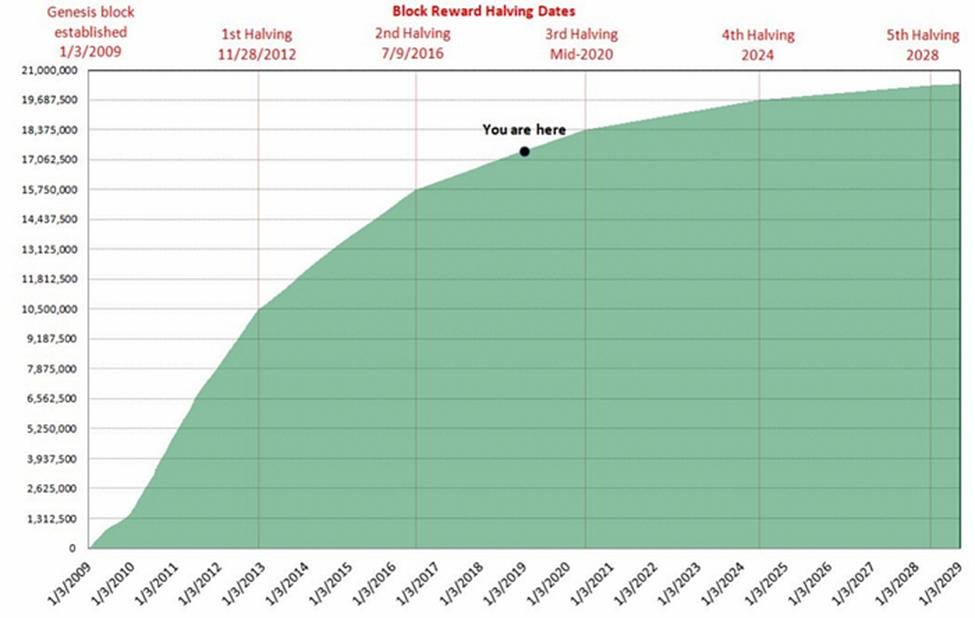

The price of the cryptocurrency will go up with time as 18.57 million Bitcoins are already being mined in less than 12 years of its creation.

83% of all Bitcoins are already in circulation and movement and only 17% of Bitcoins are left from which 15% of Bitcoins are expected to be mined by the year 2030. And the rest 3% will come into existence until 2140.

What is Bitcoin?

Bitcoin is a virtual currency. It is a type of money that is not controlled by any institution or government and is based on a decentralized network.

Btc coin price plays a significant role in understanding the dynamics of this market.Bitcoin came into being in 2009 by an unknown person or team, probably Satoshi Nakamoto. The Bitcoin transactions are checked and verified by nodes that are computer networks around the globe.

The Bitcoin transaction is called Blockchain. The nodes keep a record of all the Bitcoin transactions from the creation of the Bitcoin till the end.

Why Should You Know How Many Bitcoins Exist and How Many Are Left to Mine?

There are many reasons you should know about how many bitcoins exist and how many are left to mine, some of the reasons are as follows:

- Limited Supply: The maximum supply of Bitcoin is 21 million coins and 18.57 million bitcoins are already in circulation.

- Remaining Bitcoins: There are only 17% of Bitcoins left to be mined.

- Impact on Value: In the future value and price of Bitcoin will be much higher than today because the supply is limited.

- Volatility: The prices and value of Bitcoin may also become unsteady.

- Security: The security of the mining process is very foolproof and the transactions can’t be tempered.

- Informed Decisions: all this information will lead you to make better decisions regarding the Bitcoin investment.

Exploring the Technical Rationale behind Bitcoin Fixed Supply Limit

One of the unique features of Bitcoin is that it has a limited supply and its value will be multiplied many times when the limit will finish. On 10th, October 2023 there were 19,509,537 bitcoins already in circulation and movement and only 1,490,463 bitcoins left to be mined because it has a limit of 21 million Bitcoins only. The limited supply feature enhances the value and price of the cryptocurrency.

What Happens to Miners When All Bitcoins Are Mined?

When miners of Bitcoin mine the block, they get a reward in return but once the supply limit of 21 million Bitcoins is complete the miners will only earn money through the transaction fees instead of the Block rewards.

The current miners will keep getting benefits even when all Bitcoins are mined. The reports suggest that the Bitcoin supply limit will never reach 21 million because of the use of rounding operators in the Bitcoin codebase.

What Will the Bitcoin Network’s Response Be?

If in the future the network’s transaction volume grows, transaction speeds may slow down. The system of Bitcoin is more about accuracy and honesty than speed.

According to Bitcoin experts, Bitcoin will become an extra asset if the number of transactions in the network becomes less.

Big players will take their place in the game instead of small retail traders of Bitcoin. Which will make trading more expensive and transaction fees will be raised.

How is the Limited Supply of Bitcoins Achieved?

Bitcoin’s owner has fixed the limit of Bitcoin up to 21 million. The limited supply of Bitcoins is administered through a fusion of mining and the Bitcoin halving process.

Bitcoin mining allows the production of new bitcoins.

| Method | Description |

| Mining | Bitcoin mining is done by solving multiplex mathematical problems using special computers and miners get rewards in return. |

| Bitcoin Halving | After every four years, the reward for mining bitcoin is reduced and this process is called Bitcoin Halving. |

| Loss of bitcoins | Some users lost their passwords and private keys to access and use Bitcoin resulting in bitcoins permanent loss of Bitcoins. |

| Total Bitcoin Supply | The fusion of mining, halving, and loss of bitcoins administer the limited supply of Bitcoins. |

Why is Bitcoin’s Supply Limited?

The supply chain of the new Bitcoins does not change by its algorithm, even if the amount of miners keeps changing with time.

One block of Bitcoins is produced every ten minutes and it yields 6.25 Bitcoins. In the year 2140 0.000000001 Bitcoin are awarded per block.

Miners will earn through the transaction fees only.

What is the Effect of Limited Supply on Bitcoin?

The effect of Bitcoin’s limited supply over the years is as follows:

- 2009: Many Bitcoins from its early years are lost because the miners lost the keys and passwords for those Bitcoins. Also, there were some cryptocurrencies like DigiCash and HashCash that were not decentralized like Bitcoin. One block of Bitcoin used to give 50 Bitcoins at that time.

- 2010: The value of Bitcoin has come a long way in 2010 an American miner bought 2 pizzas from 10,000 Bitcoins.

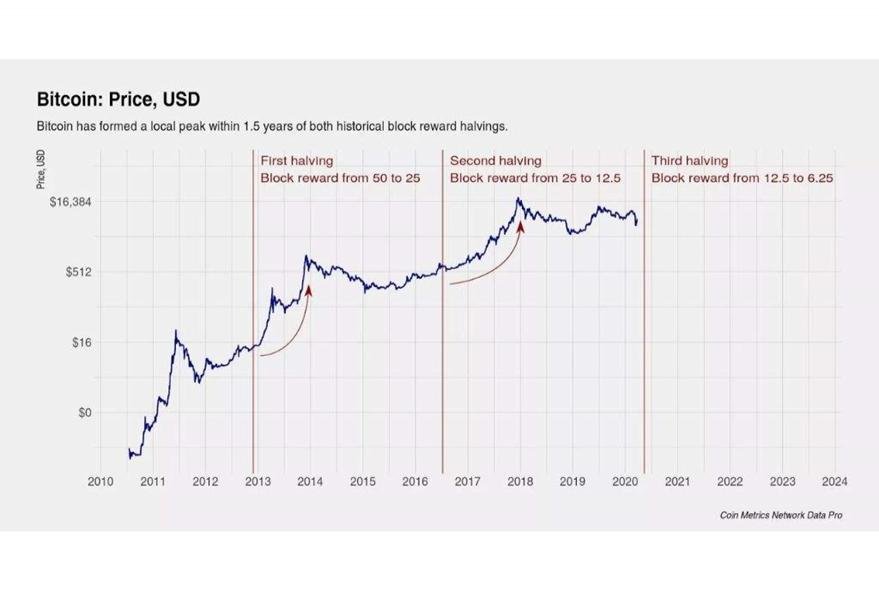

- 2012: One Bitcoin was $200 at the end of 2013 and for one block of mining used to give miners 25 Bitcoins only in the first halving.

- 2016: one block of mining used to yield 12.5 Bitcoins in the second halving.

- 2020: Each block used to give 6.25 Bitcoins in the third halving. The value of Bitcoin was around $10,000 and was multiplied four times in the coming year.

Bitcoin Halving Events

The value of Bitcoin become high and high with time. In 2010 an American bought two pizzas for 10,000 Bitcoins and now you can buy 37 million pizzas with 10,000 Bitcoins.

The value and price of Bitcoin are high because it is now hard to mine and also the supply of Bitcoins is very limited.

The Future of a Limited Supply Bitcoin

The limited supply feature of Bitcoin is unique and interesting. It was mentioned in the source code of Bitcoin that the supply limit of Bitcoins is 21 million only.

18.57 Bitcoins have already been mined by the miners which is 83% of total Bitcoins and according to Bitcoin experts, 97% of Bitcoins will be in circulation. The rest of the 3% of Bitcoin will last for the next 100 years.

Why Bitcoin`s Hard Cap is Less Likely to Change

Bitcoin Hard Cap is by design protected against any kind of alteration in its system by its creator along with its governance model. The hard cap change is also resisted due to the architecture of Bitcoin. Those who still desire to change it are left with just grudges.

Incentives

There are several Miners who might be willing to change the hard cap of Bitcoin. This change is considered to temporarily increase the revenue for miners but at the cost of the core investment thesis for Bitcoin. On the other side, many miners consider the scarcity of Bitcoin as a factor to keep its value higher than other digital currencies.

Even if the change happens for a mere increase in the miners` revenue the loss of faith in the network will be catastrophic. And in some cases irreversible price drop. This will in return put the miners at a huge loss. But whenever the Bitcoin takes a steep dive, the miners feel uncomfortable due to incurring losses.

Bitcoin Governance

If someone thinks that the hard cap of Bitcoin could change then he lacks the understanding of BTC as a consensus-based network. There are a range of source codes of BTC. And every node in Bitcoin`s network is run on completely independent software while denying any invalid Blocks.

This is despite the nodes running the recent version of the BTC Core, but still, some are running the previous version. In other words, the BTC core could be altered a little bit, but it is close to impossible to convince thousands of nodes.

The other aspect is that the miners do not control the network or its rules. Miners have to create new Blocks and also verify the transactions. After submission, thousands of nodes validate these Blocks. This ensures proof of work and the production of enough amount of new Bitcoin. It is pertinent to mention that if nodes do not find the rules being followed then Blocks created by the miners will be rejected ultimately.

How the Hard Cap of Bitcoin could be altered

Change in hard supply cap is possible on paper but it could be changed with joint efforts of different groups. First things first, the Developer plays a major role by writing and implementing the code to ensure the required change.

After a successful discussion among the group/community, the change is then incorporated into the Bitcoin Core.

The group also has to agree upon an activation path for successful transfer. But here is a catch the network has to adopt all the nodes or will be faced off the network. Support from nodes and miners is necessary for the activation path.

However, the Bitcoin governance issues have plagued the mining process. With ever-increasing mining speed with powerful computers, the limited supply cap is nearing even faster. But still, there are 120 years remaining.

Projected Timeline for Bitcoin Mining of Remaining 3 Million

We need to have a closer look at the timeline of remaining Bitcoin mining through the halving event. You will be glad to know that the recent rate of mining is at around 6.25 BTC per Block. This means that translates to 1 Block every 10 minutes. In other words, 900 newly generated BTC come into the market on a daily basis.

It is pertinent to mention that the halving event occurs 210,000 Blocks after every four years. The reward is divided in half while reducing it to 3.125 BTC. Actually, these events along with the price of the BTC play a crucial role in the timeline of Bitcoin mining. This all means that the last BTC will be mined in the year “2140” almost after 120 years.

Halving Events & Influence on Mining

The halving events are designed to be programmed into the protocol of Bitcoin. And this is done to manage the BTC supply. The profit of the halving event is reduced to half after its equal division. This may discourage some miners to stop mining.

This occurrence may have both good and bad effects on the network of the Bitcoin. Consequently, the transaction process is slowed down making the network not much safer.

On the other flip side, eh halving event may increase the BTC price and limited supply affects enhanced prices. As you might have known less supply and high demand result in higher prices. Thus, increasing prices of the BTC in having events.

Factors Affecting Bitcoin Mining

It is important to understand that Bitcoin mining is not an easy task to achieve. The process involves using high-powered computers to solve highly complex mathematical solutions. These are then used to add new and authenticate transactions to the BTC Blockchain.

This whole process is called Bitcoin mining. To make you understand the concept, here are some important aspects:

| Transactions | Users make the transaction globally in digital form. |

| Blocks | These transactions are then brought together in a setting called the “Block”. |

| Miners | These miners could be taken as the general miners but mining the BTC digitally using powerful computers while solving complex mathematical problems. |

| Proof of Work | The required mathematical problems require a lot of computing power thus the use of powerful computers. This process is referred to as “Proof of Work”. |

| Adding to the Blockchain | When a problem is solved by the miner, they are added to the new Block of Transactions to the Blockchain. |

| Reward | New Bitcoins are given to the miners after solving the mathematical problems. The miners also get the transaction fee. |

| Repeat | The process is repeated after every 10 minutes, while new Blocks are being added to the Blockchain. |

| Mining Difficulty | It is referred to as the difficulty faced in solving a problem. |

| Difficulty Adjustment | Due to the high complexity of the mathematical problems for creating BTC. That is why mining difficulty is adjusted called “Difficulty Adjustment Algorithm (DAA)” to make the process easier and faster. |

FAQs – Exploring the Technical Rationale behind Bitcoin Fixed Supply Limit

Some of the frequently asked questions (FAQs) about exploring the technical rationale behind Bitcoin’s fixed supply limit are as follows:

Q1: What is Bitcoin mining?

Ans: The process of Bitcoin token creation is called Bitcoin mining. Miners solve complex mathematical problems through special powerful computers.

Q2: How Many Bitcoins Have Been Mined?

Ans: The total Bitcoin production limit is 21 million. 18.57 million bitcoins have been mined already leaving only 3 million Bitcoins behind.

Q3: How many of the 21 million Bitcoins are left?

Ans: There are around 1,609,181.3 Bitcoins left to be mined from the total 21 million.

Q4: How long does it take to mine 1 Bitcoin?

Ans: It depends on the hardware and software of the computer. In general, with good hardware, it takes around 10 minutes to mine 1 Bitcoin.

Q5: What happens to mining fees when Bitcoin’s supply limit is reached?

Ans: The main source of income for Bitcoin miners will be transaction fees once the Bitcoin supply of the 21 million limit is completed.

Conclusion:

Exploring the Technical Rationale behind Bitcoin’s Fixed Supply Limit must have provided you with sufficient knowledge that the limited supply was set by its creator. The good news is that the remaining 3 million will be mined in the next 120 years, which is enough time.

Bitcoin and cryptocurrency are still in the development phase with an ever-changing landscape with the introduction of new digital currencies. But as mentioned earlier, not a single Bitcoin could be mined after the limit of 21 million coins.

For more information on Bitcoin visit Qnnit.com and check out Dogecoin vs Bitcoin: Beginners Guide to Choose Best Investment or if you are wondering Is It Too Late To Buy Bitcoin?